Whilst taxation rates are not a priority to share investors when they commence investing, over time they can become of increasing importance. This can happen when your share portfolio is increasing in value and you wish to sell a particular share. In this situation Capital Gains taxation rules are important, in particular the rule of holding an investment for twelve months to pay reduced tax on the capital gains. Readers should refer to the Australian Taxation website www.ato.gov.au and look up capital gains for further information.

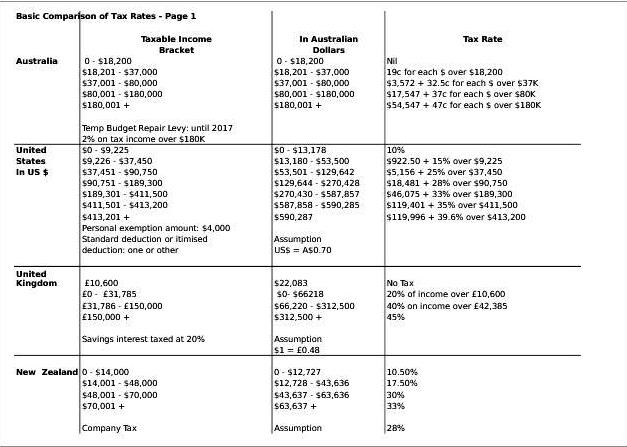

Click on the image below to access the full pdf document.