Our long-term stock selections again were positive for March with Wende leading with paper profit of $4,990 followed by John & Colin. Overall, the list was $6,630 positive across the 20 members

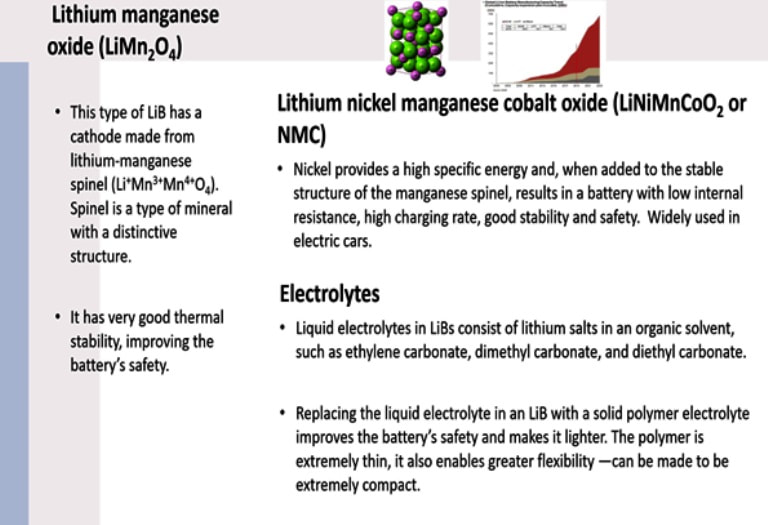

Our tea break included a small offering of tiny Easter treats was followed by Les who gave an insight into the paper handout on Altech (ATC); a company with a new electric storage battery to be produced in Germany based on Solid State materials with Sodium Chloride as the symporter. There are no moving parts such as fans to keep the battery cool and fire risk is non-existent. Another handout listing on one page of stocks “Fundamentally Sound” thanks to Don who said this listing is updated yearly and lists 100 stocks and it was suggested the full list be emailed out after the meeting.

Our stock listing of “Real Time Stocks” with dividend has Nola, Neville, Sue, Neena and Colin leading with greater than $700 profit with 11 members ahead of the initial purchase of $9,980. Overall, a good result with 4 members wishing to sell their stock and purchase a new stock (WAM ex-dividend date being 18 April) to obtain a new dividend before the next meeting on 6th May. Malcolm will sell the current selected stock on paper at its peak over the next 3 weeks and buy WAM & CDM as requested. Our May meeting, we will have had announced by NAB, ANZ, & WBC dividends and ex dividend dates. This will provide a chance to buy these stocks as the dividend should be close to previous solid results by banks.

Finally, our monthly short-term selections were positive for 14 out of our 20 members. There were 2 requests for new stocks being for WAM and CPV. Overall, across the 20 stocks by members the result is $11,230 or 5.5% positive.

Our next meeting will be 6 May 2024 at 2pm.

Malcolm Sanders

Convenor - Australian Shares and Stock Market